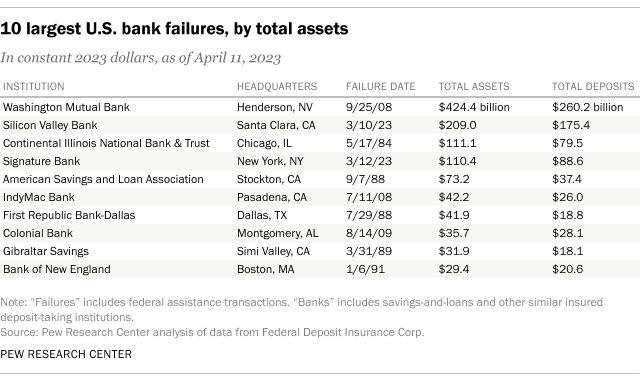

Pew – “The collapses in March of Silicon Valley Bank (SVB) and Signature Bank – two of the largest U.S. banks to fail since the Great Depression of the 1930s – have led some to wonder if the nation may be headed for a new widespread banking crisis.SVB, which catered to technology startups and venture capital firms, had more than $209 billion in assets at the end of 2022, making it the second-biggest bank to fail since the Federal Deposit Insurance Corporation (FDIC) started keeping records in 1934.Signature – which counted many big New York law firms and real estate companies as customers and was one of the few mainstream banks to seek out cryptocurrency deposits – had nearly $110.4 billion in assets at the end of 2022, ranking it as the fourth-largest bank failure after adjusting for inflation.

Since the creation of the FDIC during the Depression, the United States has gone through two major banking crises, both of which caused hundreds of institutions to fail. Aside from SVB and Signature, the largest U.S. banking failures (as measured by total assets) all happened during those two earlier crises. Four decades ago, the prolonged savings-and-loan crisis devastated that industry. Between 1980 and 1995, more than 2,900 banks and thrifts with collective assets of more than $2.2 trillion failed, according to a Pew Research Center analysis of FDIC data. More recently, the mortgage meltdown and subsequent global financial crisis took down more than 500 banks between 2007 and 2014, with total assets of nearly $959 billion. That includes Washington Mutual (WaMu), still the largest bank failure in U.S. history. WaMu had some $307 billion in assets when it collapsed, equivalent to more than $424 billion in today’s dollars. (The aggregate figures don’t include investment banks such as Bear Stearns and Lehman Brothers, which weren’t federally insured, nor banks that were sold under pressure but didn’t technically fail, such as Countrywide Financial and Wachovia.) Outside of those two crisis periods, American banking failures have generally been uncommon, at least since the end of the Great Depression. Between 1941 and 1979, an average of 5.3 banks failed a year. There was an average of 4.3 bank failures per year between 1996 and 2006, and 3.6 between 2015 and 2022. Before SVB and Signature, in fact, it had been over two years since the last bank failure…”

Sorry, comments are closed for this post.